Yay, it's finally time for responsible delivery growth!

Investors say so, so it has to be true.

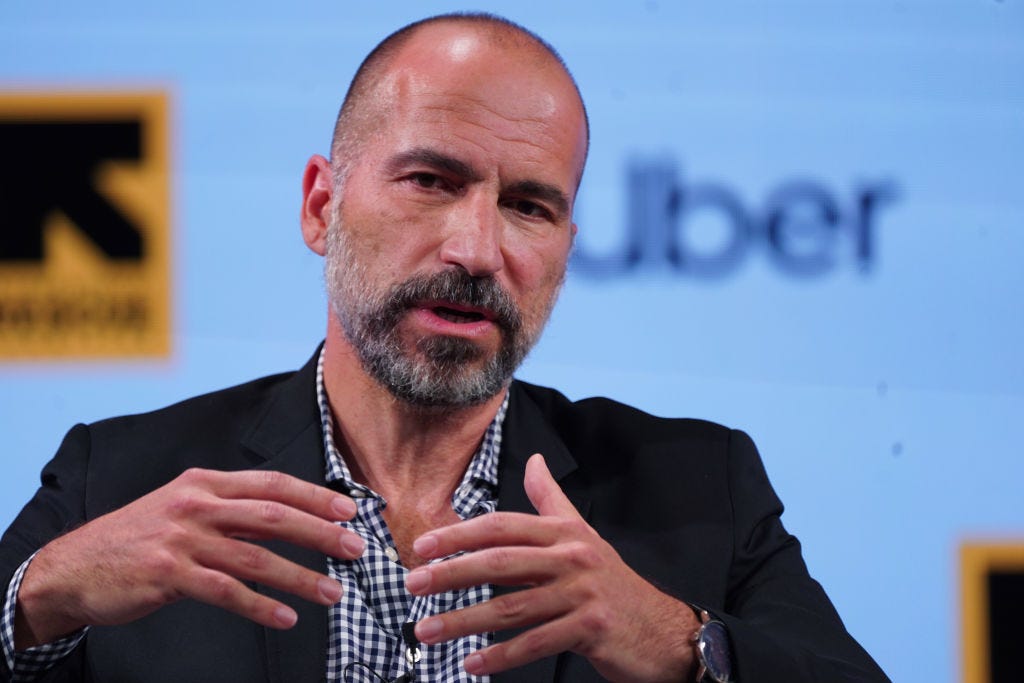

Uber CEO Dara Khosrowshahi says investors are happy with Uber’s growth in the delivery market, but he thinks it should be growing even faster.

He wrote this in a message to employees a few days ago, as first reported by CNBC, outlining the company’s strategy to weather challenging market conditions: war in Europe, an unending global pandemic, record inflation, and [this writer gestures broadly]... everything else. We’re in the midst of a “seismic shift,” he said, before telling employees the company will tighten its purse strings while slowing down on hiring and cutting inefficient marketing expenses.

Uber’s delivery business kept the company afloat as the rideshare business tanked in the earliest days of Covid. At one point in 2020, it was bigger than rides, based on adjusted net revenue. It’s still punching above its weight in the company; Khosrowshahi told investors and analysts during Uber’s recent earnings call that promoting its rides business within the Uber Eats app is working to “resurrect riders back into the reopening.” (“We frankly weren't sure if it [was] going to work,” he said of the cross-promotion on the call.)

But investors expect profitability, and that’s where Khosrowshahi says Uber is heading, this time on a free cash flow basis. Per coverage in The Verge:

Uber has long been criticized based on the way it calculates its adjusted profits. The company’s definition of EBITDA includes an unusually large list of exclusions and is widely seen as an inaccurate measure of the company’s overall profitability.

Then there’s growth.

Together, Uber Eats and Postmates — the delivery company Uber acquired in 2020 — make up a reported 27 percent of the U.S. delivery market sales to competitor DoorDash’s 59 percent, according to data last updated in April. In its most recent earnings report, DoorDash’s performance beat analysts’ expectations.

Uber is fighting the (other) delivery giant on all fronts as the companies continue to add new products and services for restaurants and other retailers. In its quest toward overall profitability, Uber will keep going after new partnerships in the grocery and convenience space, but likely won’t be building out its own chain of dark convenience stores or grocery options.

“We believe that we're able to get essentially 100 percent of the experiential benefits of fast grocery through partnership and avoid the kind of capital investments that you have to make in terms of leases, opening up a bunch of stores all over cities, in addition, frankly, to the defocusing of the team,” Khosrowshahi said on the earnings call.